Dogecoin Price Tops Tend To Follow Surges In Retail Futures Activity, Analysis Shows

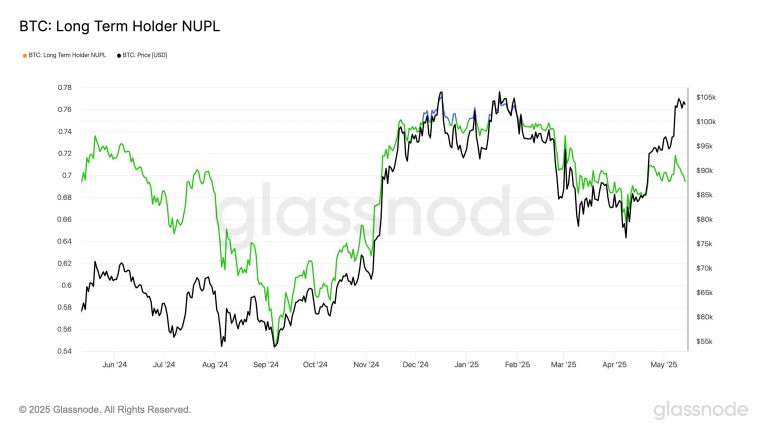

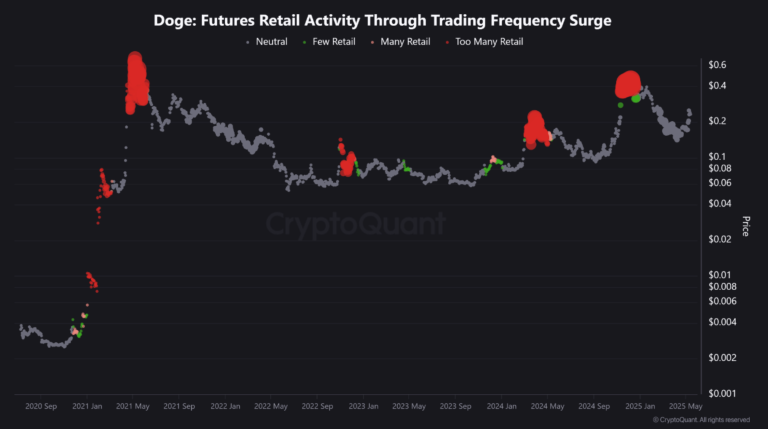

Dogecoin (DOGE) is up 48.7% over the past month, as the broader crypto market rallies amid easing concerns over a potential global tariff war. Although the leading memecoin has posted impressive gains recently, analysts believe there may still be room for DOGE to climb before reaching a cycle top. Analyst Identifies Signal That May Predict Dogecoin Top According to a recent CryptoQuant Quicktake post by contributor burakkemeci, DOGE price tops often align with a surge in retail futures trading activity. The analyst shared the following chart illustrating the relationship between DOGE price peaks and periods of heightened high-frequency futures trading by retail investors. The above chart features red bubbles that mark periods of excessive retail trading activity in the DOGE futures market. These bubbles consistently appear near major price peaks, suggesting the market may be overheating during those phases. Related Reading: Dogecoin Hits Critical Zone—Here’s What 3 Leading Analysts Are Watching In contrast, green and pink bubbles on the chart represent periods with lower retail participation. These phases typically coincide with more stable or “healthier” market conditions, which could offer better entry points for new investors. The analyst emphasized that monitoring these red bubbles may help both traders and investors anticipate potential short-term tops in DOGE. Spikes in retail participation often reflect heightened market greed – frequently a precursor to sharp price corrections. At present, Dogecoin futures activity appears to be in a neutral zone, indicating that the asset may still have room to grow before nearing an overheated state. This view is echoed by crypto analyst Anup Dhungana. In a recent post on X, Dhungana shared the following weekly DOGE chart showing a breakout from a long-term falling wedge pattern – a bullish technical setup that often precedes price rallies. Based on this breakout, the analyst forecasts that DOGE could reach $1 in the current market cycle. All Eyes On $1 DOGE The $1 price target has long been a symbolic milestone for Dogecoin enthusiasts. During the 2021 bull run, DOGE reached an all-time high (ATH) of $0.73 but ultimately fell short of the coveted $1 mark. Related Reading: Dogecoin Pullback May Be Short-Lived—Here’s The Next Price Target This time, however, several analysts believe that Dogecoin could finally hit the $1 milestone. Noted crypto analyst Kevin recently pointed to $1.10–$1.25 as a plausible target, based on Fibonacci retracement levels. However, seasoned market watcher Ali Martinez cautioned that DOGE must first overcome a significant resistance level at $0.36 to sustain its bullish momentum. At press time, DOGE trades at $0.22, up 1% in the past 24 hours. Featured image from Unsplash, charts from CryptoQuant, X, and TradingView.com